How does Interchange Plus Pricing Work?

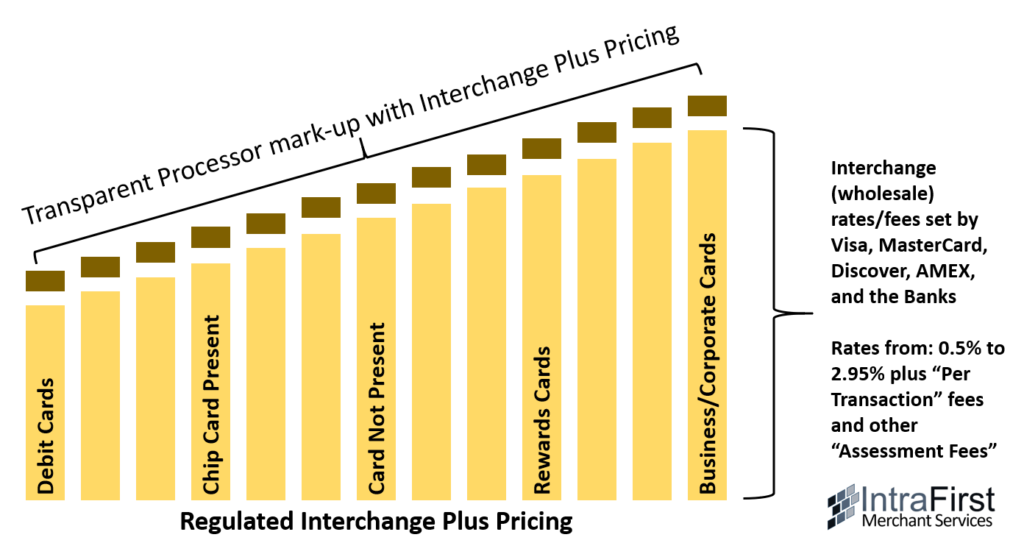

The costs involved in interchange plus include a fixed markup applied directly to the interchange fees published by Visa, MasterCard and Discover. Therefore, the “plus” is the processor’s markup that’s applied to each credit card transaction.

The processor’s markup is usually expressed as basis points. This is a unit of measurement that equals to 1/100 of one percent, expressed as .01%.

At IntraFirst we believe in being up-front and transparent. Our Interchange Plus plan places a 0.19% mark-up over Interchange (the wholesale rate). Check around if you want to, we don't think you can find a lower rate.

Ready to start saving big money?

Are you ready to experience true transparency from your processor? No more hidden fees, rate creep, or mumbo-jumbo sales pitches.

Confused? Call us (833) 357-0001

Our Rate Lock Guarantee

We guarantee that our Cost+ (%) margin will never increase for the life of your account. While we cannot guarantee the Visa and MasterCard Interchange, merchants can rest assured that our margin will remain the same. Just one of our commitments that helps build long-term relationships with our merchant, without the need for cancelation fees.